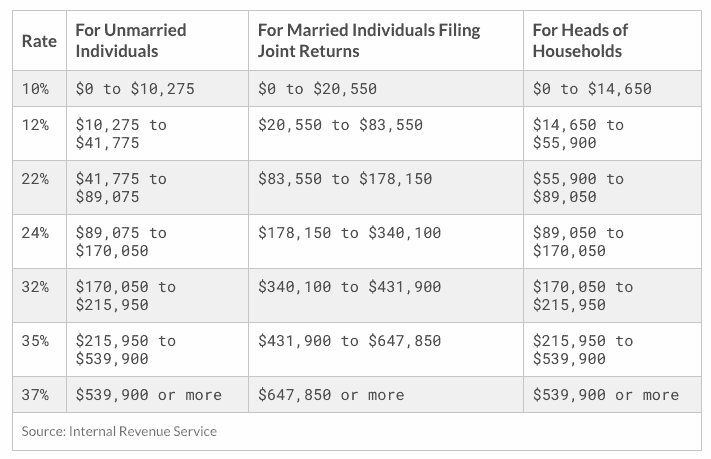

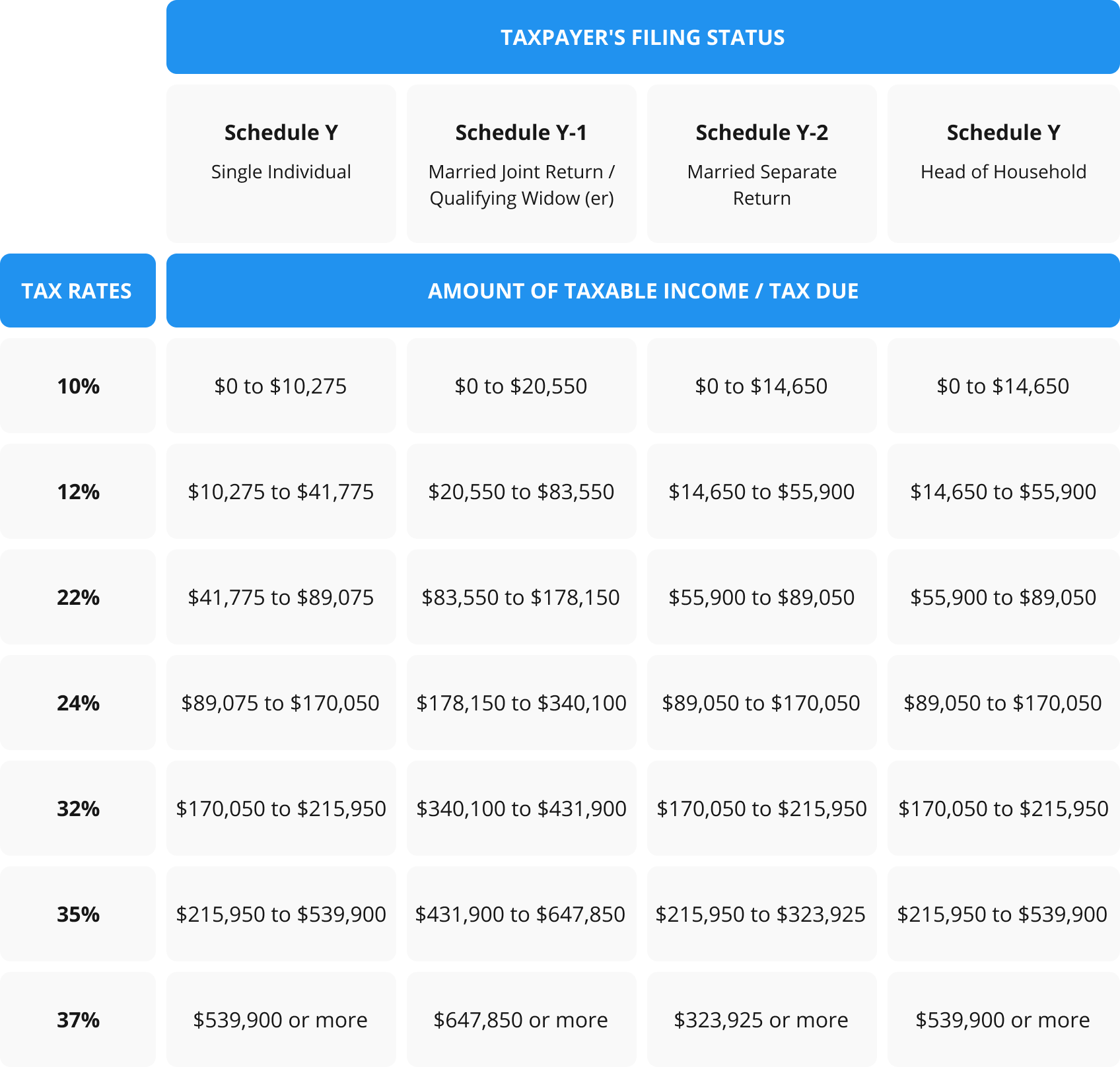

2022 tax brackets

Your bracket depends on your taxable income and filing status. 2022 tax brackets for taxes due in April 2023 announced by the IRS on November 10 2021 for individuals married filing jointly married filing separately and head of household.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

For married individuals filing jointly.

. Heres how they apply by filing status. Tax brackets for income earned in 2022 37 for incomes over 539900 647850 for married couples filing jointly 35 for incomes over 215950 431900 for. 1 day ago32 for incomes over 182100 364200 for married couples filing jointly 24 for incomes over 95375 190750 for married couples filing jointly 22 for incomes over.

There are seven federal income tax rates in 2022. 21 hours agoThe standard deduction will also increase in 2023 rising to 27700 for married couples filing jointly up from 25900 in 2022. To access your tax forms please log in to My accounts General information Help with your tax forms Fund tax data 2022 tax.

This guide is also available in Welsh Cymraeg. The IRS has set seven tax brackets 2022 taxpayers will fall into. Single filers may claim 13850 an increase.

10 12 22 24 32 35 and 37. Single tax rates 2022 AVE. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

You and your spouse have taxable income of 210000. The current tax year is from 6 April 2022 to 5 April 2023. That puts the two of you in the 24 percent federal income tax bracket.

10 12 22 24 32 35 and 37. This means that these brackets applied to all income earned in 2021 and the tax return that uses these tax. Remember these arent the amounts you file for your tax return but rather the amount of tax youre going to pay starting January 1 2022.

There are seven federal tax brackets for the 2021 tax year. Your tax-free Personal Allowance The standard Personal Allowance is 12570. Residents These rates apply to individuals who are Australian residents for tax purposes.

17 hours agoThe agency says that the Earned Income Tax Credit which is for taxpayers with three or more qualifying children will also rise from 6935 for tax year 2022 to 7430. 2022 Tax Bracket and Tax Rates There are seven tax rates in 2022. Here are the 2022 Federal tax brackets.

Resident tax rates 202223 The above rates do not include the Medicare levy of 2. It is taxed at 10 which means the first 9950 of the. Here are the new brackets for 2022 depending on your income and filing status.

For example for single filers the 22 tax bracket for the 2022 tax year starts at 41776 and. The top marginal income tax rate. 35 for incomes over 215950 431900 for married couples filing jointly.

The 2022 and 2021 tax bracket ranges also differ depending on your filing status. The lowest tax bracket or the lowest income level is 0 to 9950. Below you will find the 2022 tax rates and income brackets.

These are the rates for. If you can find 10000 in new deductions you pocket 2400. Taxable income up to 20550 12.

20 hours agoThe Internal Revenue Service has released a list of inflation adjustments impacting more than 60 tax provisions including tax brackets deductions and credits. 24 for incomes over. 32 for incomes over 170050 340100 for married couples filing jointly.

1 day ago10 tax on her first 11000 of income or 1100 12 tax on income from 11000 to 44735 or 4048 22 tax on the portion of income from 44735 up to 95375 or 11140.

Analyzing Biden S New American Families Plan Tax Proposal

2022 Trucker Per Diem Rates Tax Brackets Per Diem Plus

2022 2023 Tax Brackets Rates For Each Income Level

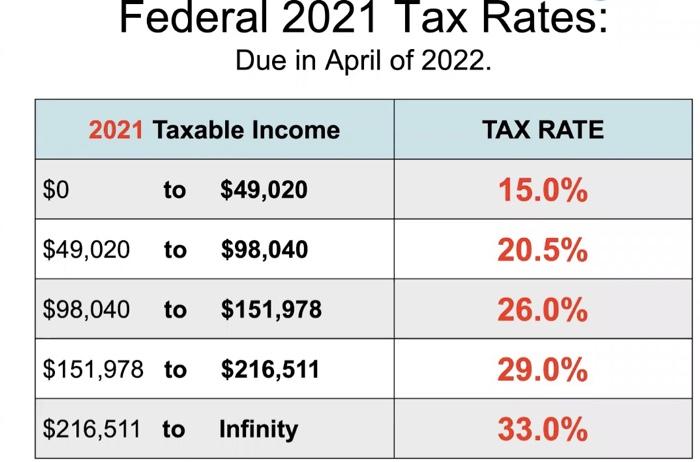

Solved Federal 2021 Tax Rates Due In April Of 2022 2021 Chegg Com

Don T Forget To Factor 2022 Cost Of Living Adjustments Into Your Year End Tax Planning Miller Kaplan

What Is The Difference Between The Statutory And Effective Tax Rate

2022 Tax Brackets Internal Revenue Code Simplified

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Tax Brackets For 2021 And 2022 Ameriprise Financial

Tax Season 2022 Tax Brackets Irs Forms Deadlines Pdffiller Blog

Nyc Property Tax Rates For 2022 23 Rosenberg Estis P C

What Is My Tax Bracket 2022 2023 Federal Tax Brackets Forbes Advisor

What Are The Income Tax Brackets For 2022 Vs 2021

How Do Tax Brackets Work And How Can I Find My Taxable Income

Irs 2022 Tax Tables Deductions Exemptions Purposeful Finance

%20(1).jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

2022 Tax Inflation Adjustments Released By Irs

Federal Personal Income Tax Rates Schedule 1 Haefele Flanagan

March 4 2022 2022 Small Business Tax Brackets Explained Gusto